Lloyd George Survey of Land Values

Introduction

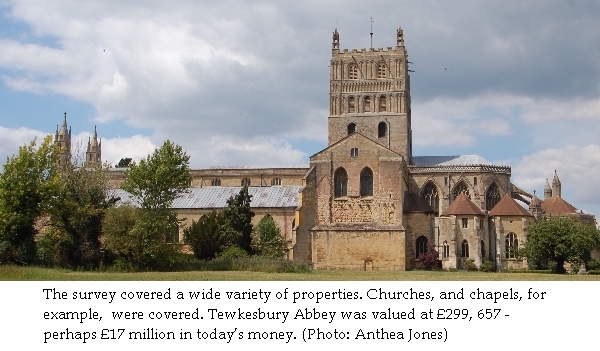

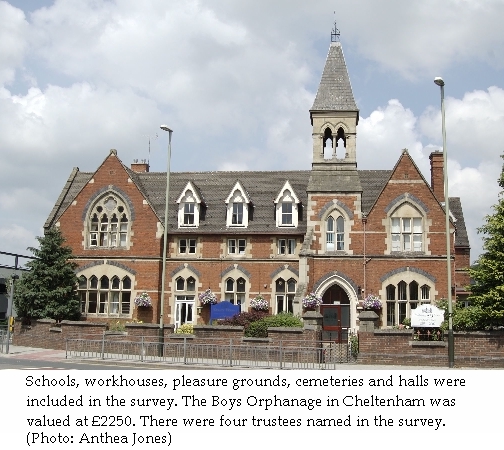

The survey of land values was undertaken in order to implement one feature of Lloyd George’s ‘People’s Budget’ of 1909. Lloyd George had introduced old age pensions the previous year, and was faced with providing revenue for this purpose, but also for the naval building programme which included new large battleships called Dreadnoughts, designed to compete with Germany’s naval building programme. The chancellor of the exchequer wished to tax the ‘unearned increment’ of land, that is, to tax windfall increases in its capital value due to chance factors such as development potential or the discovery of minerals. ‘Land’ included all agricultural land, allotments, land with barns, houses, cottages or any other buildings on it. The focus of the survey was therefore on the owners of property.

The House of Lords rejected the Budget and caused a major constitutional crisis. On 29 April 1910 they passed the budget, one year after its introduction, but their powers were shorn, and they were never again in a position to reject a money bill. As soon as the budget was passed, the Inland Revenue sprang into action. An army of surveyors was appointed. Because the survey was being undertaken in connection with taxation, it was organised by the Inland Revenue in the areas termed ‘income tax parishes’. Hence each property is located in the civil parish and the taxation parish. Charlton Kings volunteers, who carried out a trial for the Gloucestershire project, were surprised to find details of Leckhampton properties amongst their files.

Types of Record

The survey involved a mass of bureacracy and many forms, but only a few of the main classes of record have survived, compiled at different stages of the process; it is important to know at what stage each record was made. It is also important to remember that the emphasis of the survey was on owners who were to pay the tax.

Domesday Books

The so-called Domesday Books, more properly ‘Valuation Books’, are large bound volumes with a double page of headings printed ready for the entry of subsequent information. Across the country, Brian Short has listed in Land and Society in Edwardian Britain (Cambridge 1997) which Archive Offices hold the books, but experience in Gloucestershire suggests that when an Archivist said that these books survived, it might be that they covered only a limited number of places. The Domesday Books for Gloucestershire survive for the western half of the county, which was organised from the Gloucester District Valuation Office, but even then not for the Stroud area. It is necessary to check on any particular parish with the relevant archives office.

The Domesday books were made up with the names of occupiers and owners and the addresses of properties, also areas, poor rate assessment numbers and some details of the property, copied from the Poor Rate assessments. Occupiers’ names helped to identify the property exactly. Various types of property – houses, land, stables, buildings and so on were often separately itemised. The District Office then assigned an hereditament (H) number to each property or group of properties, the numbers starting from one in each income tax parish. At a later stage, owners often chose to amalgamate some or all of their properties into one hereditament for valuation, so several lines of data in the Domesday Books may correspond with one later form. Further details may or may not have been entered into these volumes at later stages of the enquiry. Unfortunately not all District Offices or clerks were equally diligent.

List of Domesday Books for the Gloucester Office in Gloucestershire Archives.

Form 4-Land

Once owners had been identified, they were sent a Form 4-Land requesting details of their property. Twelve million copies were printed. Some survive, but only by chance mixed up with later forms. They are of interest because they show whether a property was leasehold or freehold, and details such as outgoings and leases.

Field Books

Field Books were then prepared for the surveyors to verify the details and value the property as at

30 April 1909, the date specified in the People’s Budget. The date is important. The land values relate

to that date, regardless of when the survey was carried out. Changes to the occupiers’ or owners’ names,

which are often encountered, may be explained by the need to observe that date, as for example if the

Poor Rate list initially entered in the Domesday Books was compiled at a slightly different date.

The ownership of property was constantly in flux, with sale or death common reasons for changes.

Surveyors also noted the reasonable charges on the property which would reduce the tax to be paid in

the future, and any reductions in value due to the existence of public rights of way or wayleaves.

It took several years to cover all properties, and in Gloucestershire the work continued until the

outbreak of war, and in some cases into 1915, before generally being postponed and then abandoned.

In 1920 it was decided to repeal the tax for all except owners of coal mines and other mineral rights.

Field Books were then prepared for the surveyors to verify the details and value the property as at

30 April 1909, the date specified in the People’s Budget. The date is important. The land values relate

to that date, regardless of when the survey was carried out. Changes to the occupiers’ or owners’ names,

which are often encountered, may be explained by the need to observe that date, as for example if the

Poor Rate list initially entered in the Domesday Books was compiled at a slightly different date.

The ownership of property was constantly in flux, with sale or death common reasons for changes.

Surveyors also noted the reasonable charges on the property which would reduce the tax to be paid in

the future, and any reductions in value due to the existence of public rights of way or wayleaves.

It took several years to cover all properties, and in Gloucestershire the work continued until the

outbreak of war, and in some cases into 1915, before generally being postponed and then abandoned.

In 1920 it was decided to repeal the tax for all except owners of coal mines and other mineral rights.

The Field Books are in The National Archives. They can be found at TNA/IR 58. While 95,579 volumes have survived, there are gaps; each book covers 100 entries. These books contain fascinating material on the state of repair of properties, the materials used in the buildings, the number of orchard trees or amount of timber, and other such observations. Relevant data should have been entered in the Domesday Books.

Form 37-Land

Once the surveyors returned with their Field Books, Form 37–Land was filled in with the details of the acreage and valuation of the property, and the permitted deductions. A copy of the form was sent or ‘served’ on the person or persons responsible for accepting the details of the valuation; usually, but not necessarily, this was the owner or owners personally. This gave opportunity to challenge the valuation. Some owners did, and an Amended Valuation (a pink form 39-Land) was prepared, of which a few have been found in Gloucestershire. A few owners seem to have decided to increase the assessment of their property while others sought to reduce it; not all were apparently clear about the implications of the valuations for taxation. It was sometimes necessary to re-serve the form when no reply was received, or even to re-serve the form to a different person. These points are noted in the Comments section of the database.

Form 37s survive for the Cheltenham District Valuation Office, covering the eastern side of the county. Approximately half as many Form 37s survive over the whole country as Domesday Books, which is unfortunate, as they contain the information which links precisely with the record maps on which each hereditament was marked.

Form 37-Land references for the Cheltenham Office in Gloucestershire Archives.

Maps

Ordnance survey 1:2,500 sheets were generally used to record the boundaries of hereditaments as listed on Form 37s. In some cases, the Ordnance Survey provided a revised map for the surveyors to work on. Draft record maps exist in many archives offices. The Gloucestershire Archives reference is D2428/3 followed by the OS map reference. Final versions of the maps are in The National Archives, reference IR121/1 to IR121/22 and IR124/1 to IR135/9. The individual hereditaments were coloured to distinguish them, and the maps are very colourful and attractive. Map references are included here wherever they exist in the data.

The 1:2500 sheets were arranged and numbered in each county in blocks each containing sixteen squares, thus block 40 would contain sheets 40.1, 40.2, up to 40.16. These reference numbers are inserted on the index map.

A further refinement of the reference was notionally to divide a sheet into sixteen squares, each given a letter:

A, B, E, F

G, H, J, K

N, O, P, Q

R, S, T, U